How to Lower Your Monthly Expenses in 2024

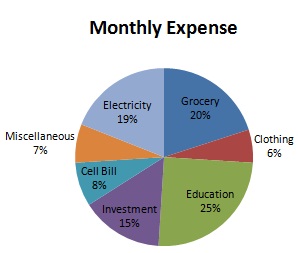

Saving money within each calendar month is one of the most essential techniques of sound financial management. As much as they become high in various fields, it becomes even wiser to minimize unnecessary expenses so that they do not affect the quality of your life. The following are strategies that are likely to assist you in cutting down your expenditure expenses in the year 2024.

1. Audit Your Subscriptions

Most people subscribe to services or products that they do not require anymore. Own up your monthly expenses like subscriptions, streaming services, apps, or magazine subscriptions. Many organizations have memberships to trade unions, unique interest bodies, or other groups; they should cancel any accounts they do not need frequently. They also recommend apps such as Trim or Truebill that can easily find and cancel all those useless subscriptions in no time, which you never remember to cancel anyway and bring you some extra monthly money.

2. Refinance High-Interest Debt

Credit card debts or personal loans, especially those bearing high interest, can easily cut down on your cash. Look into options for debt consolidation to decrease your interest rates; your payments will be lower, too. Consider current interest rates to know whether refinancing will be beneficial in mortgages or auto loans. As evidenced by the above examples, reducing your interest rates can eventually save you a good amount of money.

3. Cut Down on Energy Usage

Saving energy is one method of ensuring that monthly utility bills are cut down. Simple things such as using LED bulbs, a smart thermostat, or switching appliances when not in use can aid in decreasing your electricity bill. It might also be wise to call in an energy assessor to determine which aspects of your home are the worst offenders, such as your walls, floors, or appliances.

4. Count the Calories and Avoid Eating Out

On the same note, meal planning will help you save both time and money. Cooking everything at once and having a list of what to buy minimizes the chances of buying foods that were not planned for and decreases the amount of food thrown away. A few subtractions on dining out and preparing meals at home effectively save money. Also, as a good substitute for eating unhealthy or eating out, you may use planned portioned meals delivered to your doorstep, such as Hello Fresh.

5. Negotiate Bills and Rates

Most of the service providers, such as internet service providers and insurance companies, are generally negotiable. On your telephone call with your internet, cable, or phone company, ask them whether they can provide you with a cheaper rate. In this regard, there is information that when making a deal, it is worthwhile to examine competitors’ prices to benefit from lower prices. Review your coverage and consider getting new quotes for renewal at least once a year.

6. Buy in Bulk for Essentials

It is a fact that when the necessary goods and services are bought in large quantities, it leads to a lot of money savings. Bulk buying is always cheaper on commercial items such as toilet tissues, tissue papers, and other consumables like foods with very long shelf-life. For groceries, dry goods, and other household necessities, places like Costco or Sam’s Club, known for wholesale prices, can benefit by cutting down your monthly spending.

7. Use Cashback and Rewards Programs

Get the most out of your dollars spent by cashback and rewards features. Most credit cards provide cashback for food, gas, or, more recently, utilities. There are also applications like Rakuten or Ibotta, where you can get cash back for things you usually buy online. Each can be pretty small at first glance, but they can shave down your monthly expenses in the long run.

Conclusion

It provides guidance for cutting back one’s monthly expenses in 2024 without having to make huge adjustments. By cutting your spending to the necessary minimum, using cashback programs, auditing subscriptions, saving energy, and negotiating the bills, you can quickly adapt to that change without much drawback on your comfort. Focus on one or two tricks at a time and learn how your savings balance increases month after month.